2020 · Product Design · Mobile

Bayzat provides an HR platform to employers purchasing health insurance for their employees. Their vision is to make top-tier benefits accessible to all employers and enhance the well-being of their employees.

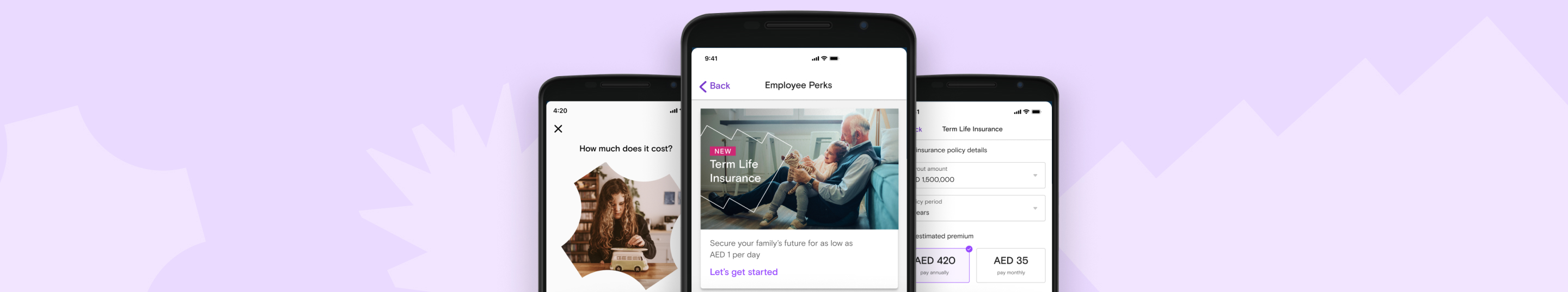

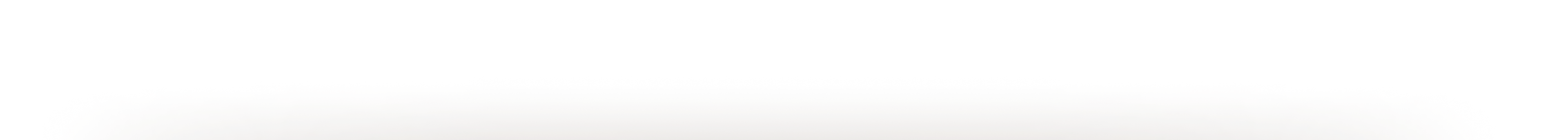

Considering user feedback and research, we determined that the most sought-after employee benefit is affordable life insurance. Hence, it was built as Bayzat's first offering in Employee Perks

User research, competitive analysis, conceptualisation, design, user testing and overseeing delivery

1 designer, 1 product manager & 3 engineers

November 2019 - April 2020

Bayzat conducted extensive research, surveying approximately 2,000 users to grasp their definition of world-class benefits. The research revealed that financial security is the top priority for employees, leading Bayzat to focus on two key opportunities.

In scope Motor, Life, Health, Travel and Home insurances

Problem statement assigned to our squad

Assisting UAE residents with financial management

Problem statement for another squad

Rapidly evaluate our target audience's preferencewith minimal design and development efforts

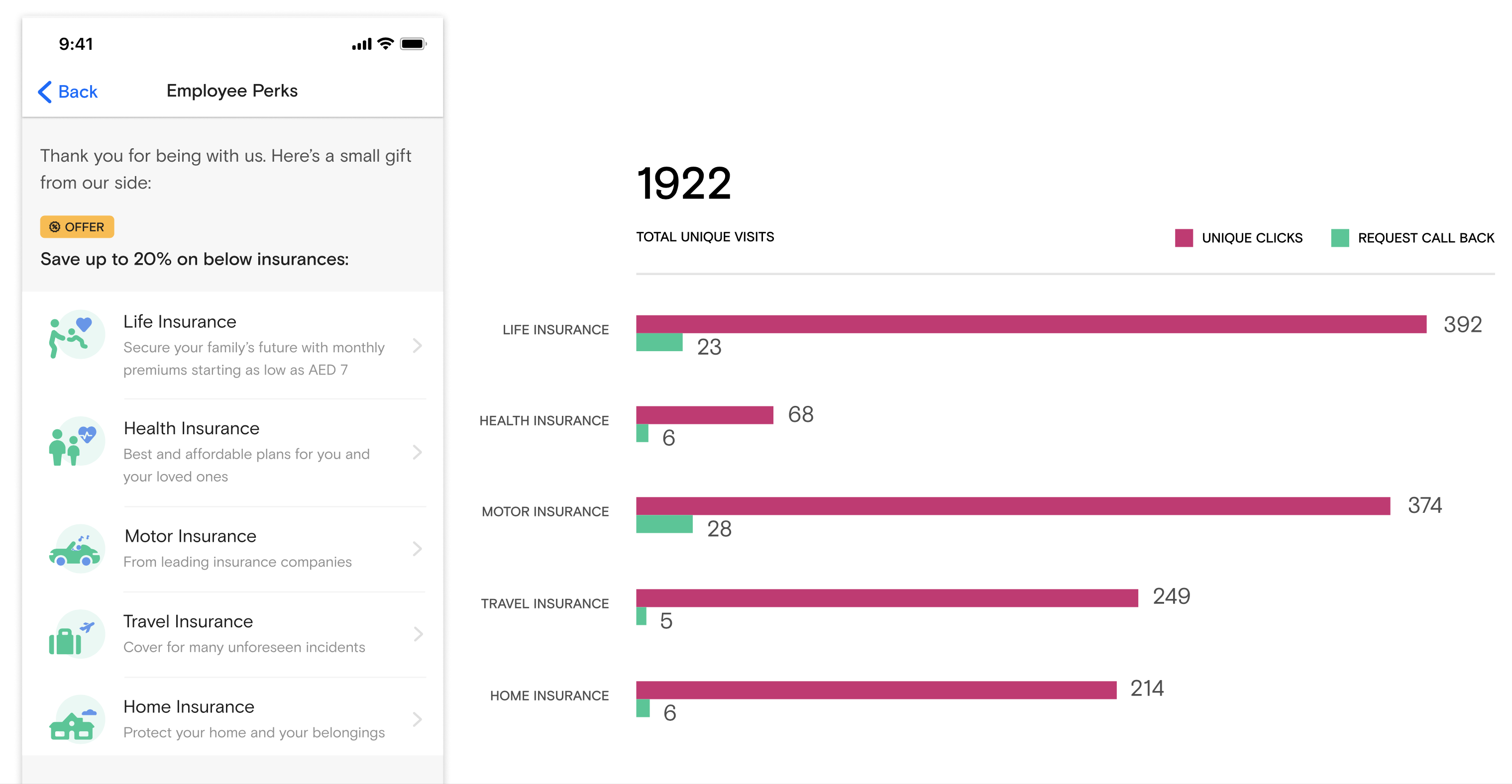

We conducted one-week fake door testing to determine the top insurance preferences among the UAE's five most common options.

Life Insurance

Motor Insurance

Travel Insruance

Health Insurance

Home Insurance

Key Takeaways

We conducted one-week fake door testing to discern user preferences, with the experience finalized by providing users with a 10% premium discount if they called to purchase insurance. Here are the insights gained from the experiment:

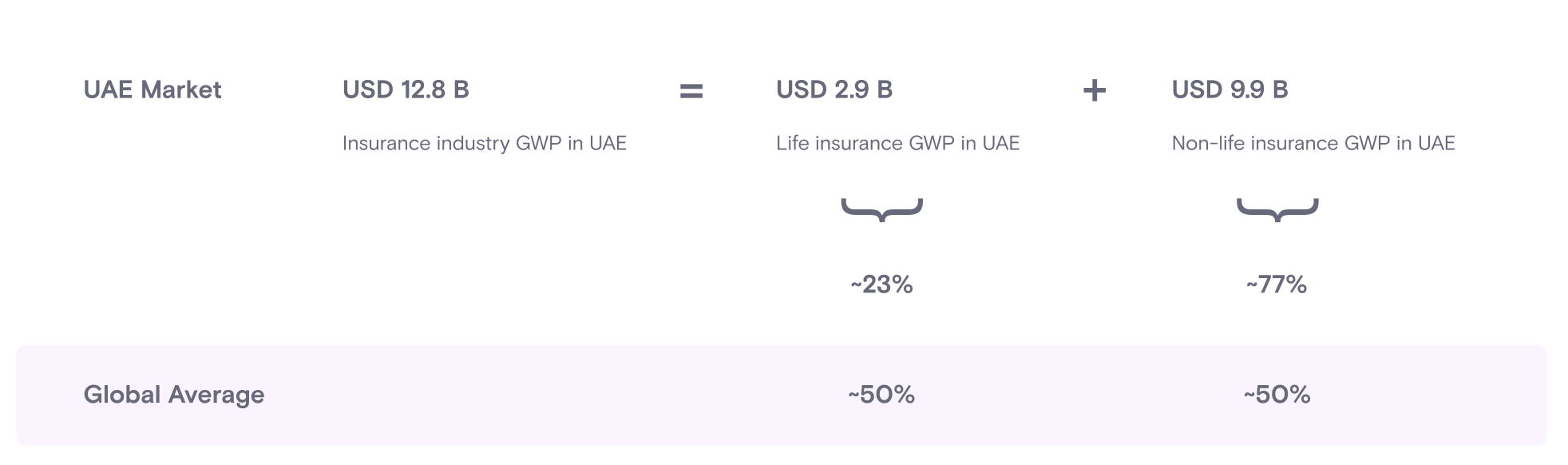

Benchmarking the UAE insurance market against global averages indicates significant untapped potential in the life insurance sector for Bayzat to further explore.

While globally, the life and non-life insurance markets are fairly balanced, the UAE's life insurance market still has substantial room for growth, suggesting a clear opportunity for expansion.

GWP = Gross Written Premium = Direct written premium + Assumed written premium

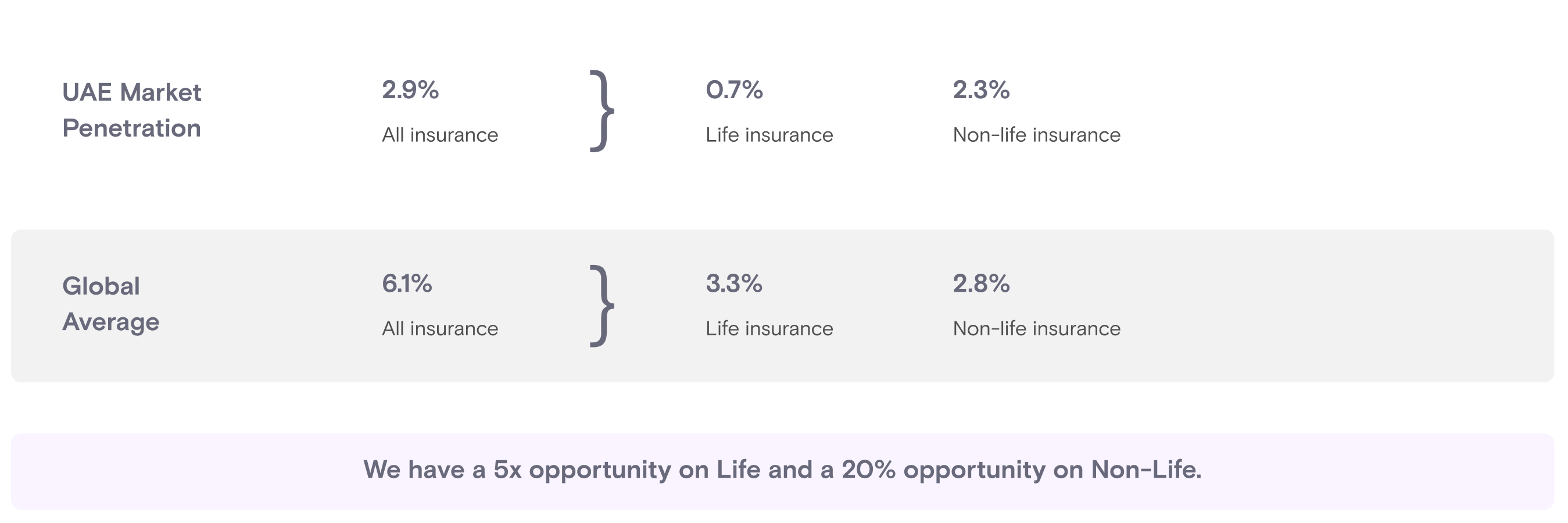

Since motor and health insurance is mandatory in UAE by law, hence the penetration of other insurance is as expected and aligns to global average. This also makes other insurances a zero sum game, whereas life insurance still has a lot of room to grow.

GWP = Gross Written Premium = Direct written premium + Assumed written premium

Based on the interests of our target audience identified through fake door testing, motor and life insurance emerged as the top preferences. However, due to operational constraints and resource limitations, we could only focus on one insurance type at a time.

Considering market gaps and potential, we strategically chose to prioritize life insurance as our initial offering. Recognizing the opportunities and complexities within the domain, including legal and third-party coordination.

We initiated user interviews for insights, then expanded with a survey for a wider audience

To understand the reasons for the relatively low penetration of life insurance, we conducted user interviews. We established the following parameters for segmenting users in these interviews:

Marital status

Life Insurance status

Family location

Salary range

Given our access to an unbiased customer base at Bayzat, we engaged with them by posting polls in internal Slack channels. We then scheduled and sent out invites at their convenience to identify our target users.

An outline of questions to help keep the interview meaningful, focused and comprehensive

People overestimated life insurance costs by threefold

Complex paperwork is a barrier to obtaining life insurance

People buy life insurance for family security or as an investment

Some discontinued due to missed premiums or a reduced need

Users prefer transparent policies with high coverage at affordable premiums

Some had life insurance in their home country before moving to the UAE

Unaware of life insurance or prefer alternative investment options

Some were uncomfortable with mortality-linked insurance

The next step was to validate these findings on a larger scale. We sent a survey to approximately 2000 existing Bayzat users with the following conversion rates:

Starts

Responses

Completion rate

Avg completion time

The survey consisted of 15 questions, logically linked to minimize each user's response to 7-8 questions.

The survey questions were derived from our user interview findings, and the key takeaways closely aligned with those from the interviews. For a detailed report of the survey, please refer to the below report:

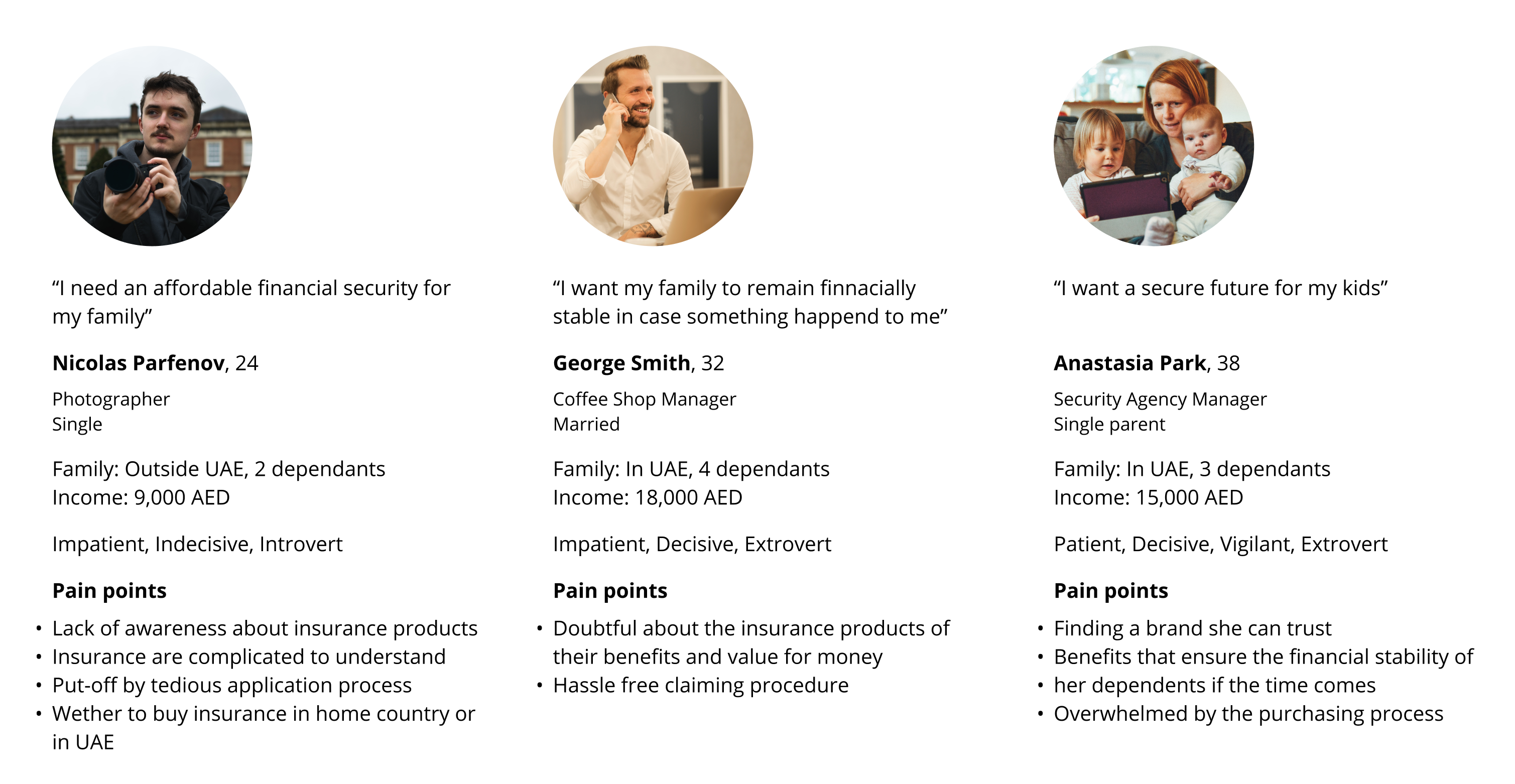

Developing detailed personas with emotions for greater empathy and understanding

Through fake door testing, we identified usage patterns and conducted user-interviews to gain a deeper understanding of our target audience

Leveraging insights from user-interviews to develop our target personas

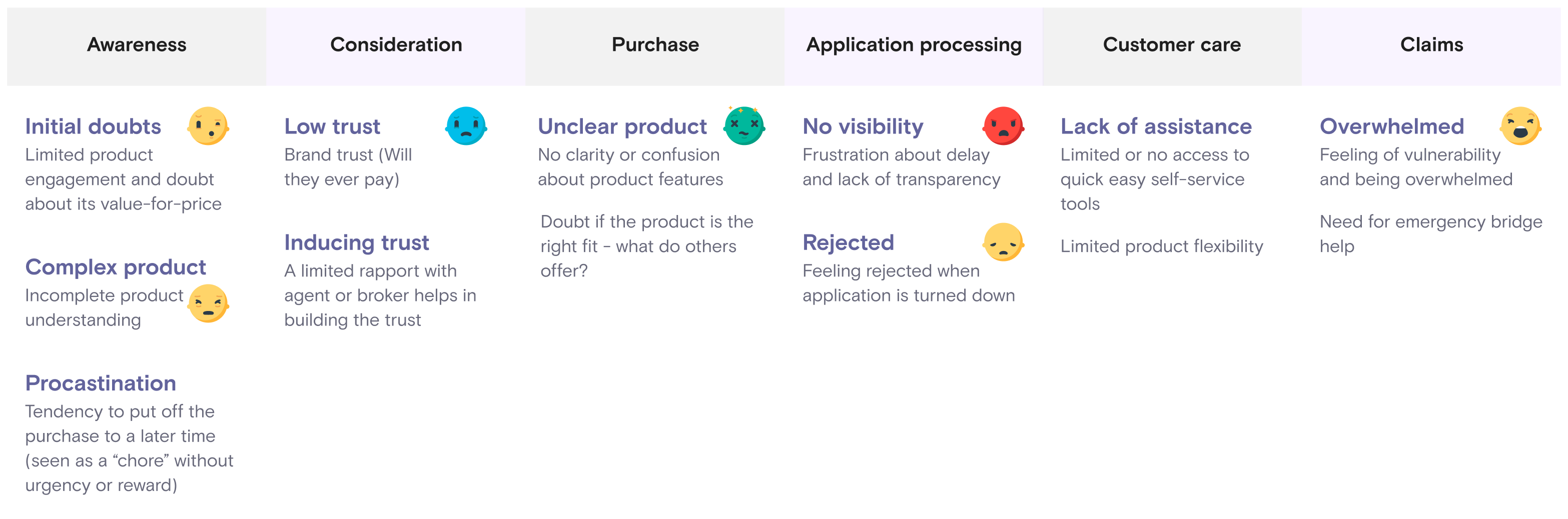

Organizing user problems into stages, accompanied by associated emotions:

Identifying key problems streamlines solution requirements

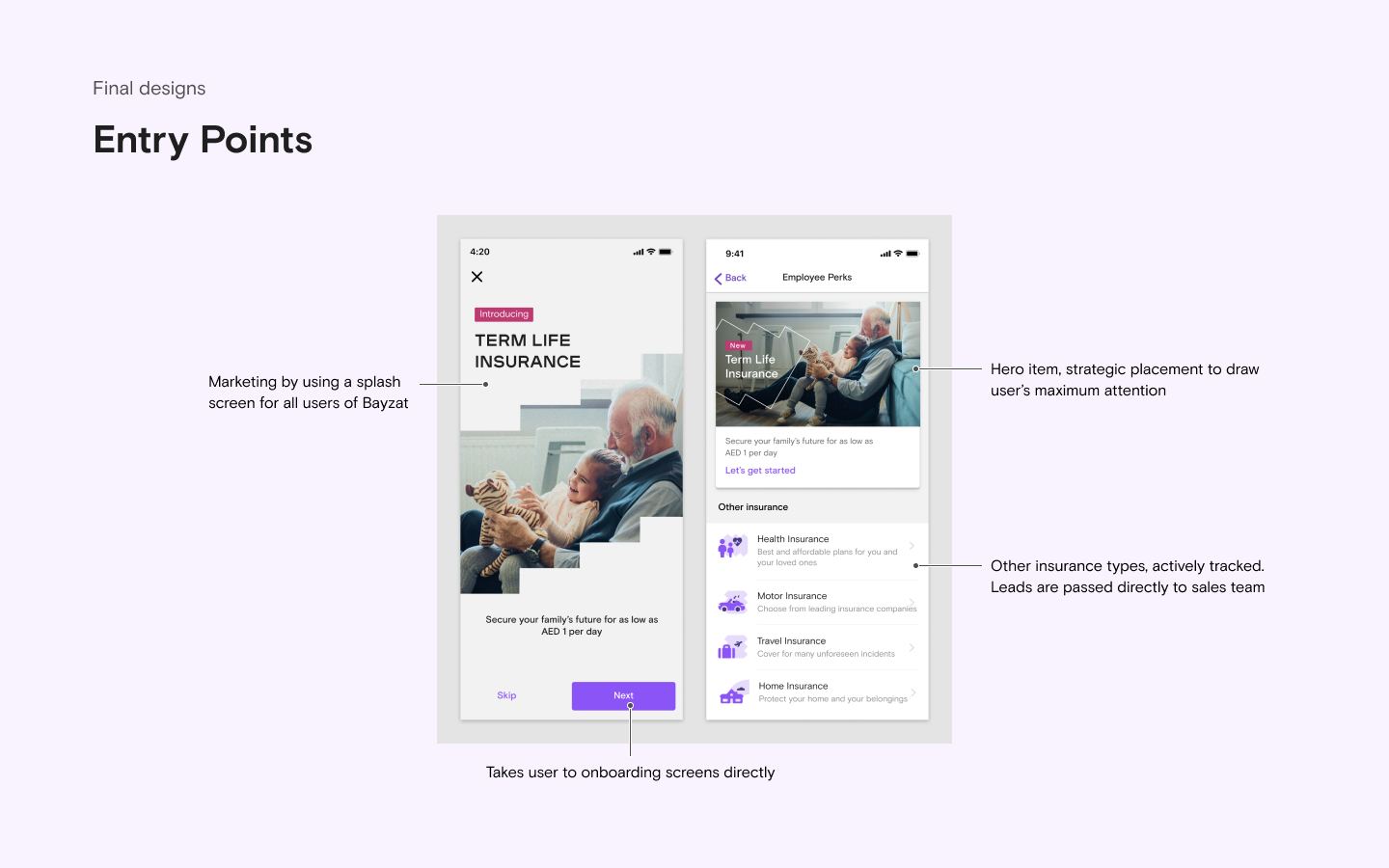

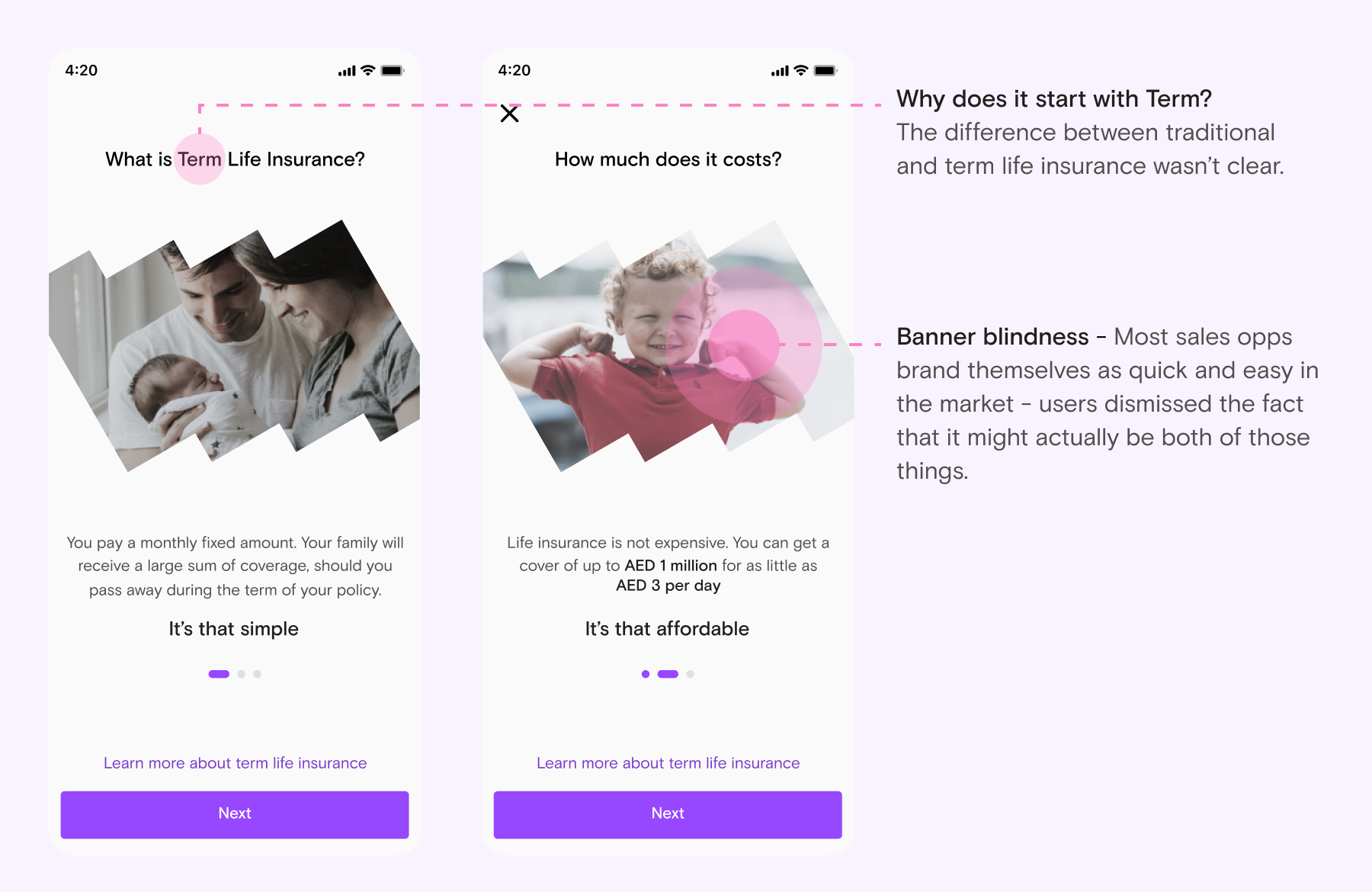

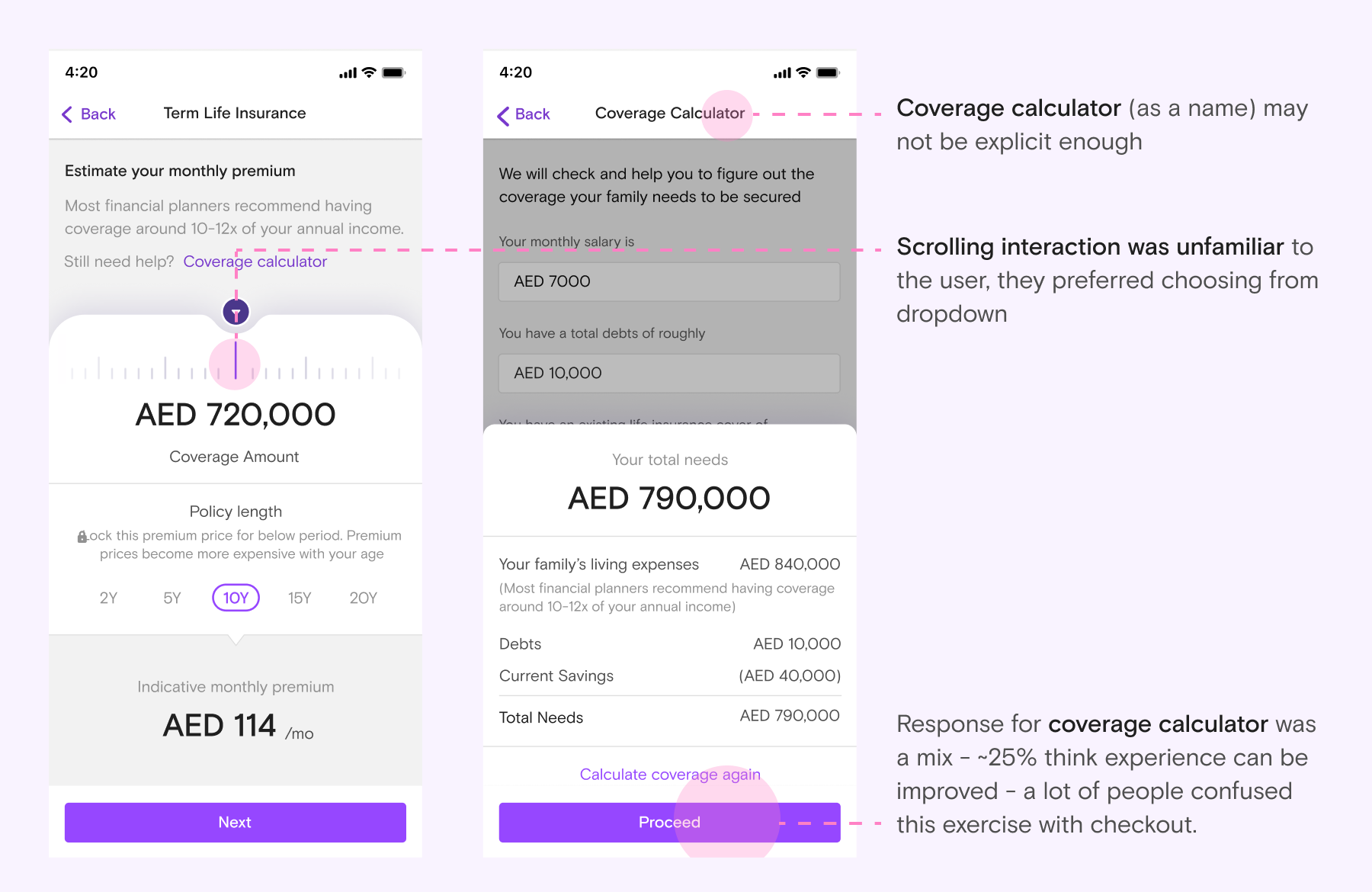

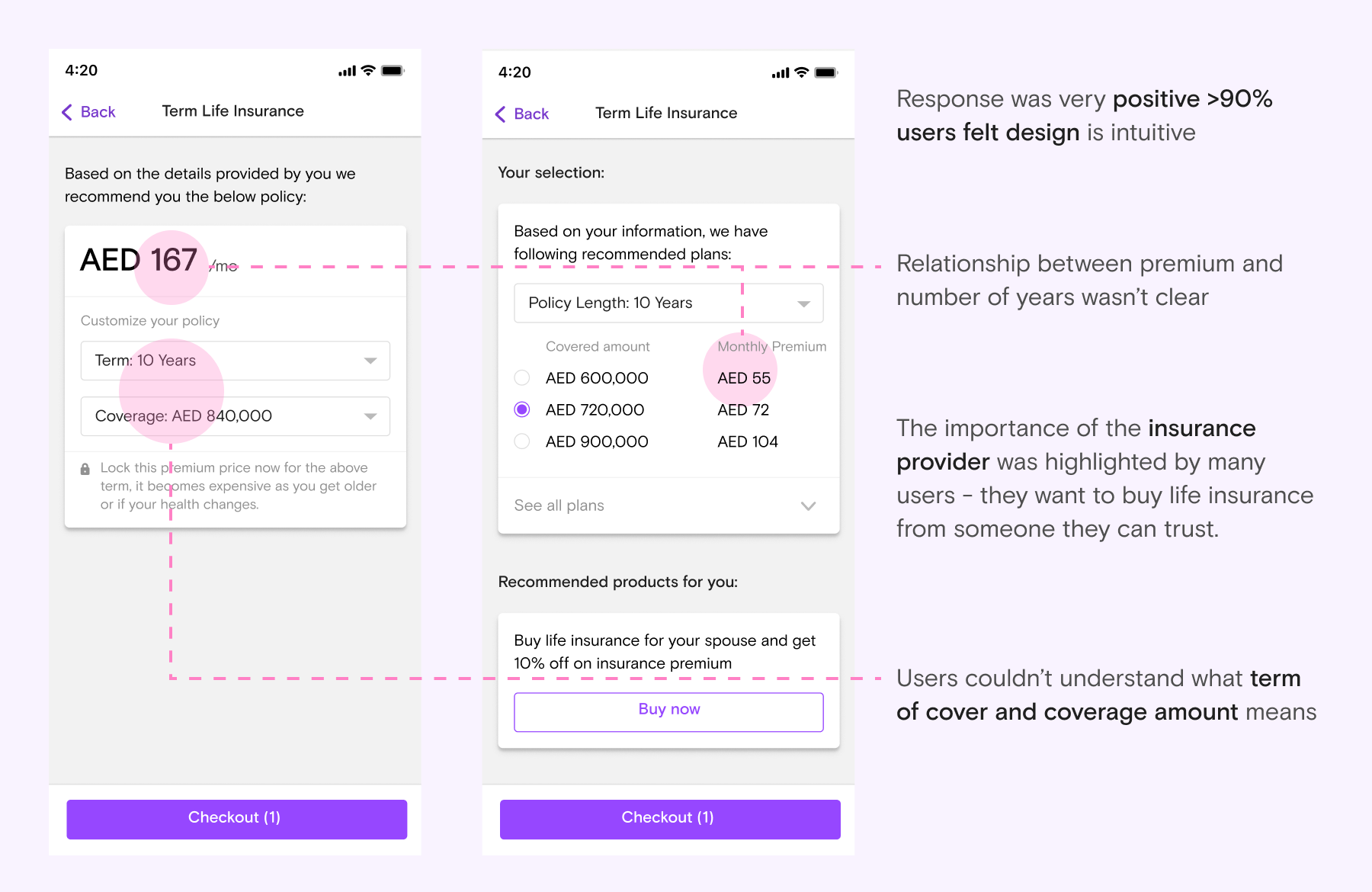

The most relevant and critical problems we aim to address are as follows:

Perception that life insurance is expensive

Perceived complexity and lack of understanding

Lack of awareness of the importance of life insurance

Misconception that the overall buying process is painful and difficult

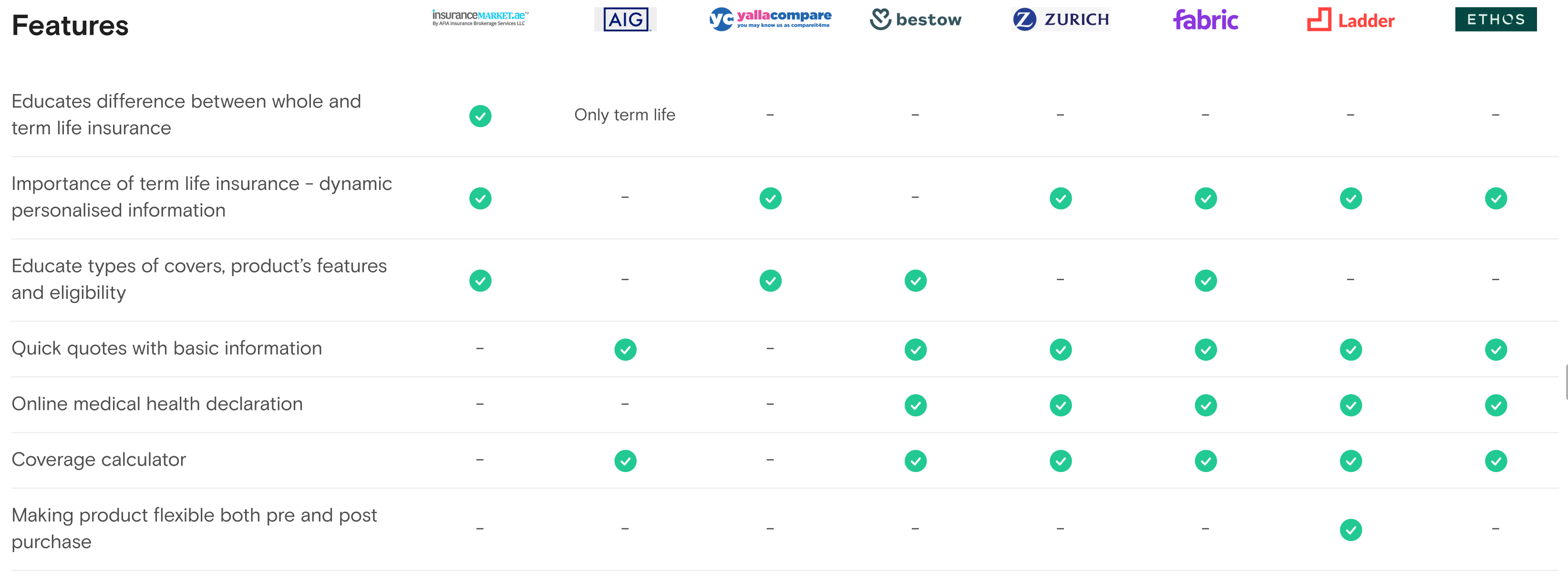

Comparing key takeaways across competitors offers valuable insights for strategic decision-making

Keywords

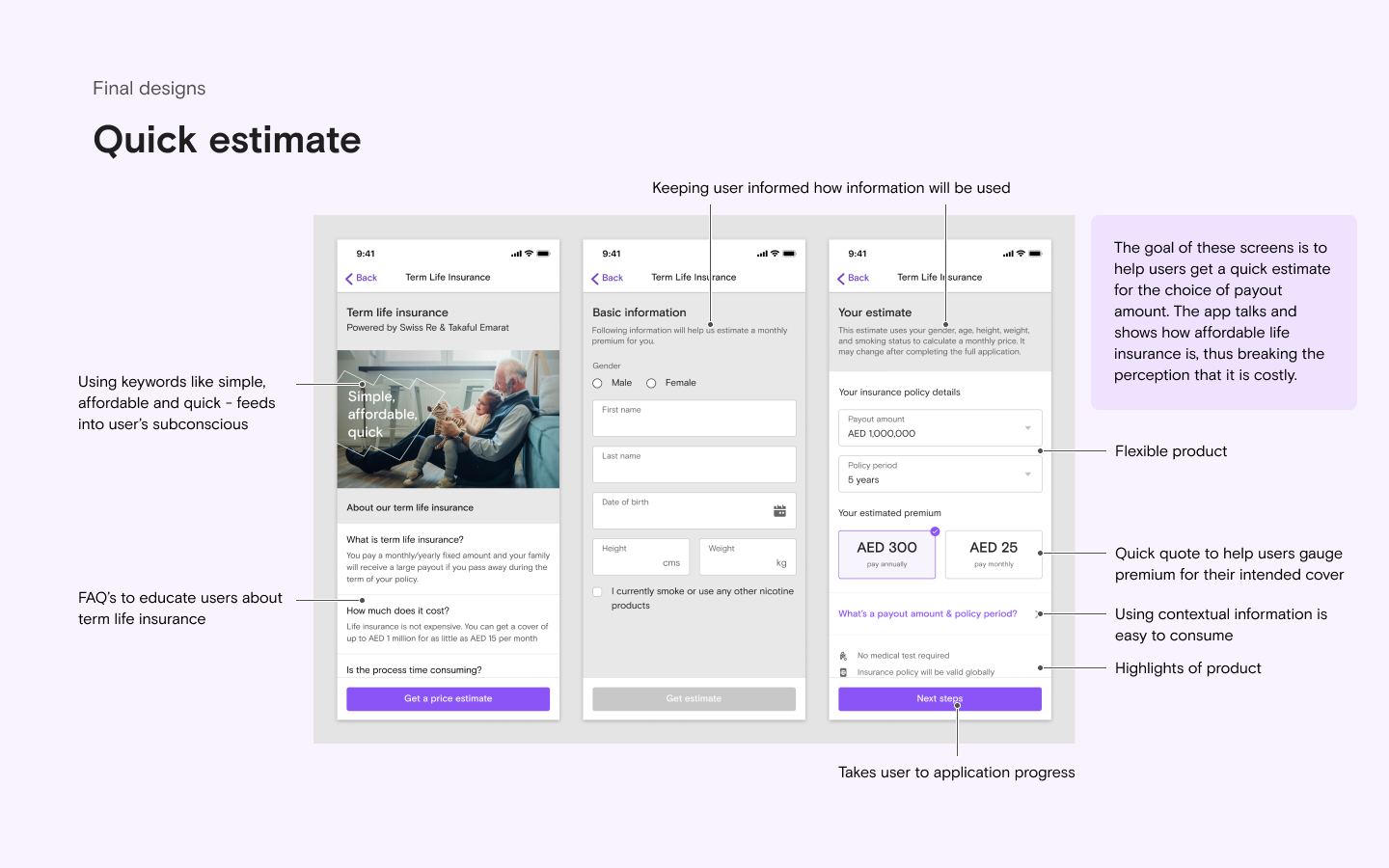

Utilizing keywords from competitor studies will assist in shaping the language for our product:

Easy · Affordable · Free quotes · Quick quotes · Instant · Simple · Smart · Flexible

Easy · Fast · No medical · Simple · Accessible · Seamless · Intuitive

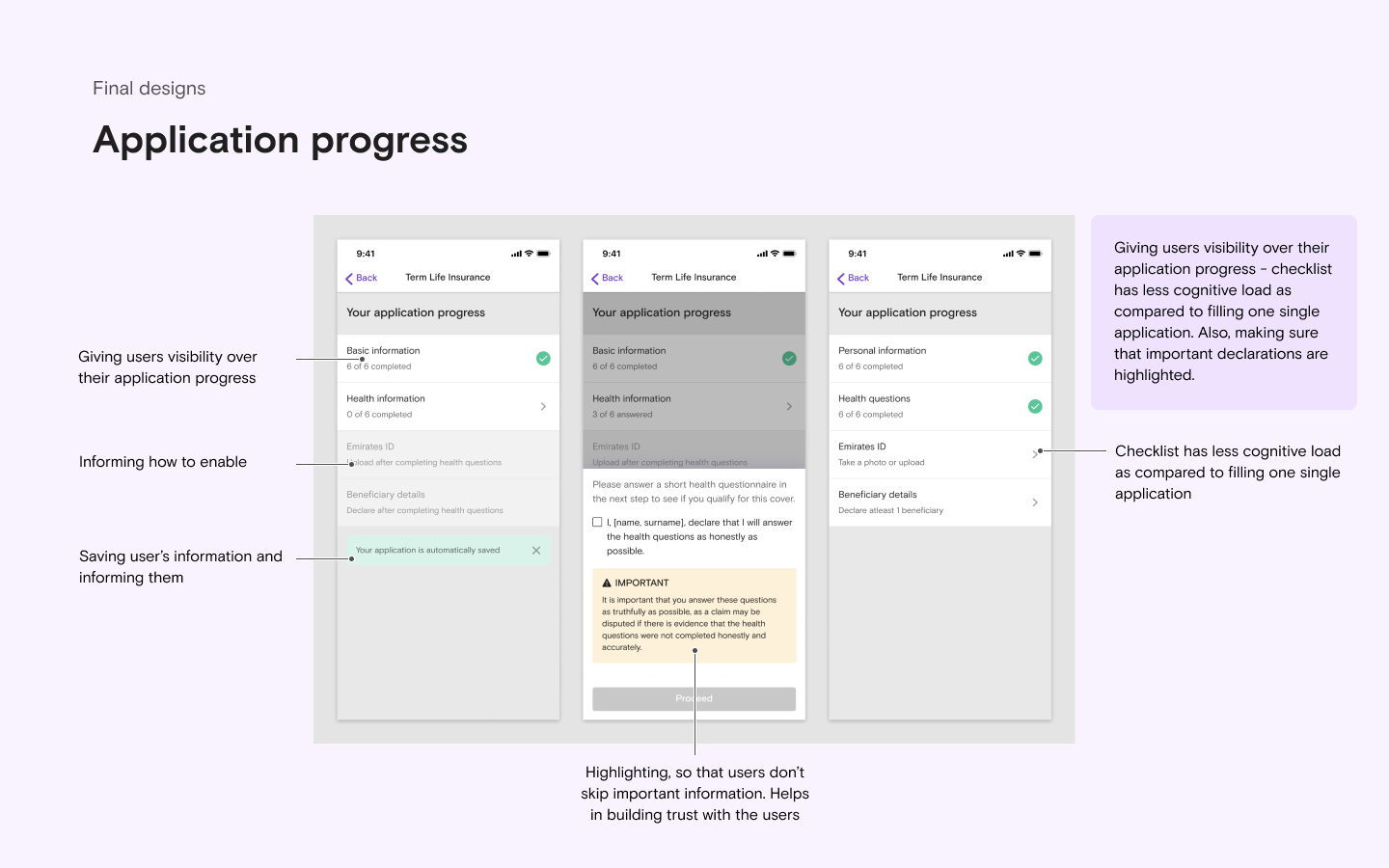

Chalking out gaps caused by legal compliance and its impact on our product

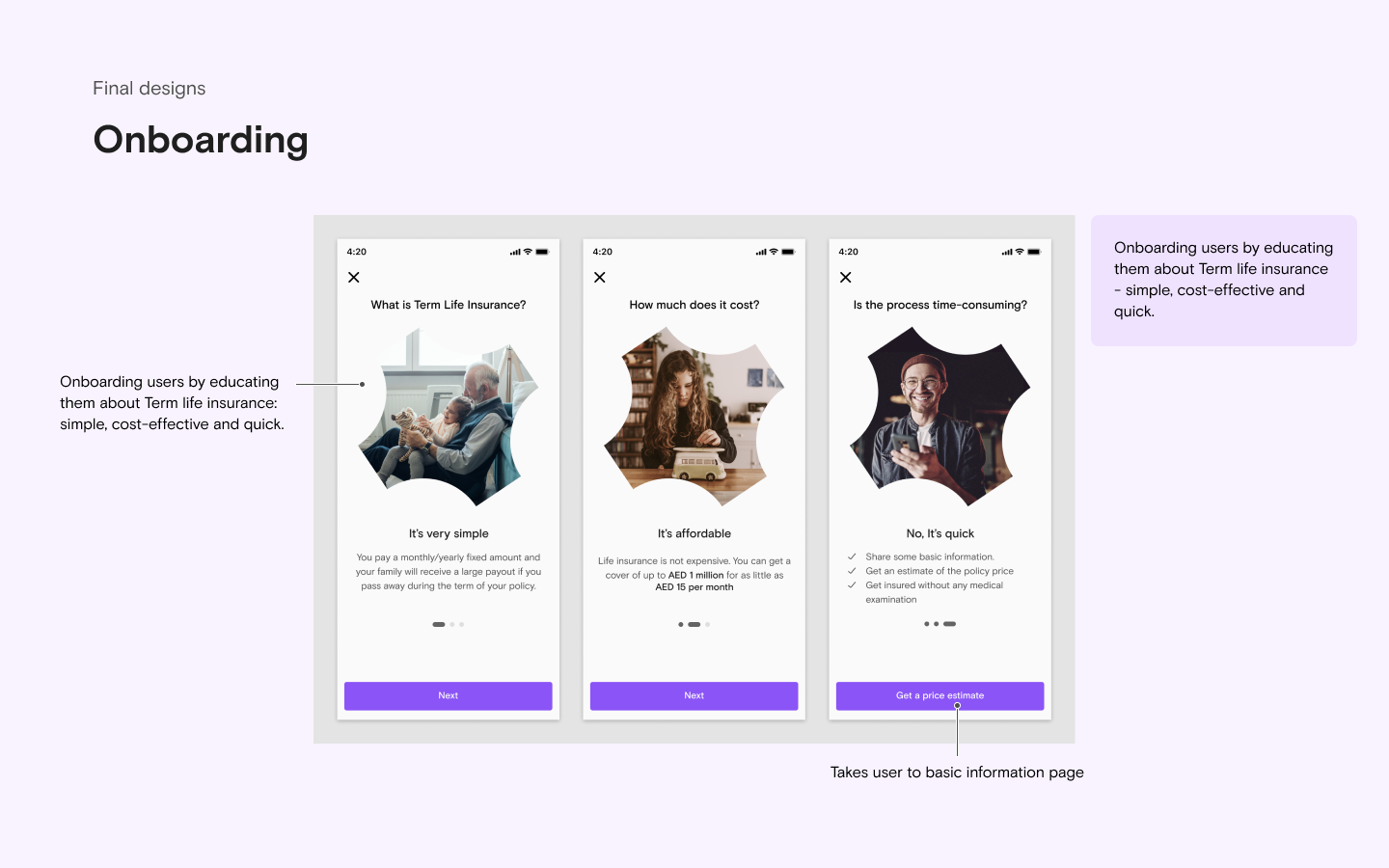

The PM for legal compliance in the product led discussions, with external parties including Swiss-re and Takaful Emarat. Key highlights from these discussions include:

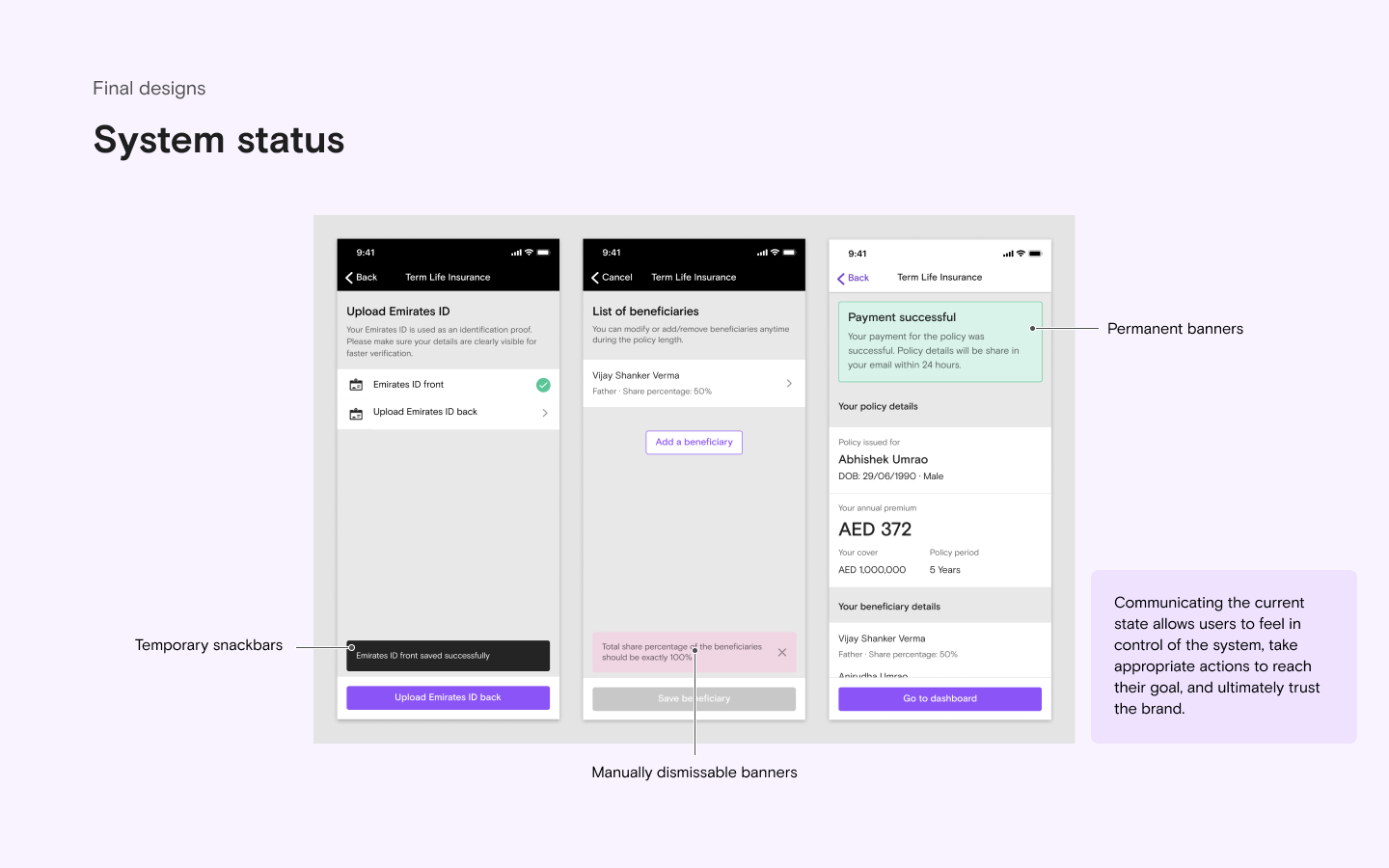

Smooth transition between Bayzat and Takaful payment gateway

Create a user interface for COVID-19 history declaration

Create a user interface for health history declaration

Enable users to upload/re-upload Emirates ID or import from Bayzat's profile

Streamline coverage selection to prevent user overwhelm

Defining a clear problem statement for our product is instrumental in aligning team members and stakeholders, ensuring our collective efforts are focused on solving the most pertinent issues.

Design a user experience that emphasizes the significance of life insurance for UAE residents and streamlines the entire life insurance policy purchasing process.

Various apporaches and concepts to initiate internal discussion and gather user feedback

Wireframes for the entire user flow were created based on concept phase feedback

You can find a comprehensive usability testing log and its insights here:

Please note: Snapshots of final designs are included in the section Product Hightlights

AI first productivity tool - fast, focused

2025 · AI · Product Strategy · 10 min read

eAssessment for IB Schools

2023 · Product Design · Web & Mobile · 10 min read

For joyful creativity in the classroom

2023 · Product Design · Web & Mobile · Available soon